island fintech oct '25

crypto chaos, ipo buzz, and southeast asia’s fintech shake-up

hey islanders,

hello from singapore, where it feels like every week brings something seismic to asia’s fintech scene. after a (long) hiatus, island fintech is back on a biweekly cadence, aiming to make sense of what matters in southeast asian finance, with just enough context and colour to keep things punchy.

if you could do me a favour, please vote on the poll at the end of the page to let me if you’re finding this useful 🙏🏽

🐠 dips

is the crypto dream collapsing? the elephant in the room that we must start with is the most recent crypto plunge, which follows singapore’s massively well-attended token2049 crypto festival. this crash was historically large, with nearly $20 billion in leveraged positions liquidated in a single 24-hour period - over ten times the liquidations during both the 2020 covid crash ($1.2 billion) and the 2022 ftx collapse ($1.6 billion). this liquidation event set a new record in crypto history for sheer volume and number of affected traders (over 1.6 million). bitcoin prices dropped sharply but later partially recovered.

🏝️if insight: this meltdown serves as a reminder that speculative digital assets will always carry volatility, underscoring the critical need for reliable infrastructure and robust regulatory frameworks. rather than rattling investor confidence, southeast asia’s crypto market is staying resilient. with strong institutional interest, many see this turbulence as part of the maturation process in building a sustainable digital asset ecosystem. to me, this highlights why true infrastructure is more important than ever.

phonepe’s quiet ipo march india’s phonepe, arguably the subcontinent’s payments juggernaut, has confidentially filed for a massive ₹12,000 crore (about us$1.5 billion) ipo. in classic fintech fashion, their approach shields key details from public view until launch. still, the numbers that have leaked are sizeable: fy25 revenue soared 40% to ₹7,115 crore.

🏝️if insight: with walmart, tiger global, and microsoft in the cap table, this is one to watch for regional cross-pollination and capital flows

singapore’s stablecoin moment: the only singapore dollar-backed stablecoin, xsgd, just hit coinbase. straitsx, its issuer, is touting instant crypto-to-sgd transactions for everyone from tourists to big local businesses. okx pay is also piloting scan-to-pay merchant services using xsgd.

🏝️if insight: this isn’t just fintech tinkering - singapore’s ambition to become a leader in digital assets is getting international backing and infrastructure. distribution is the surest moat!

singapore’s going to freeze your fund transfers: from october 15, singapore is set to require banks to hold or even reject digital transfers that cross new thresholds. designed to curb scams and boost safeguards, the regulation has sparked debate over efficiency versus security

🏝️if insight: this is a classic singapore conundrum in keeping the market safe but nimble. time will tell, but methinks that it’s worth a shot - especially if we can prevent life savings from being lost. if over cumbersome, the restrictions can always be released.

stablecoins are going to be regulated in singapore with clarity: mas’s framework on stablecoin issuers is finally trickling into real-world application. mas’s stablecoin framework, focused on single-currency stablecoins pegged to the singapore dollar or g10 currencies, requires issuers to fully back coins with high-quality reserves, maintain minimum capital, and provide users with guaranteed redemption at par value. these clear rules aim to boost trust and safety in stablecoins issued in singapore, setting a global standard for regulated digital assets.

🏝️if insight: the roadmap involves new legislative tweaks coming up soon, which should cement singapore’s reputation as one of the world’s clearest regulatory environments for digital assets.

sea digital payments are still just at the tip of the spear : according to a recent 2c2p commissioned report, indonesia’s mobile wallet transaction volume jumped from us$18.27 billion in 2023 to us$25.2 billion today; vietnam saw an 88% hike in mobile payments for e-commerce.

🏝️if insight: makes you think - with the market penetration currently just sitting at where it’s at - there’s still so much more to be done! for some context, indonesia’s unbanked population is around 100 million people, roughly 40-50% of the population unbanked. similarly, vietnam’s unbanked or underbanked population is also sizeable, with estimates around 44% lacking access or being underbanked.

hsbc will take your tokenized deposits: hsbc rolled out a blockchain-based tokenised deposit service in singapore last week, enabling real-time, 24/7 settlement of multi-currency deposits across borders. this service addresses a key pain point for treasurers dealing with volatile fx and interest rates by offering instant liquidity management, greater transparency, and operational efficiency.

🏝️if insight: watch this space as both incumbents and challengers chase the joys of ledgered liquidity for their customers.

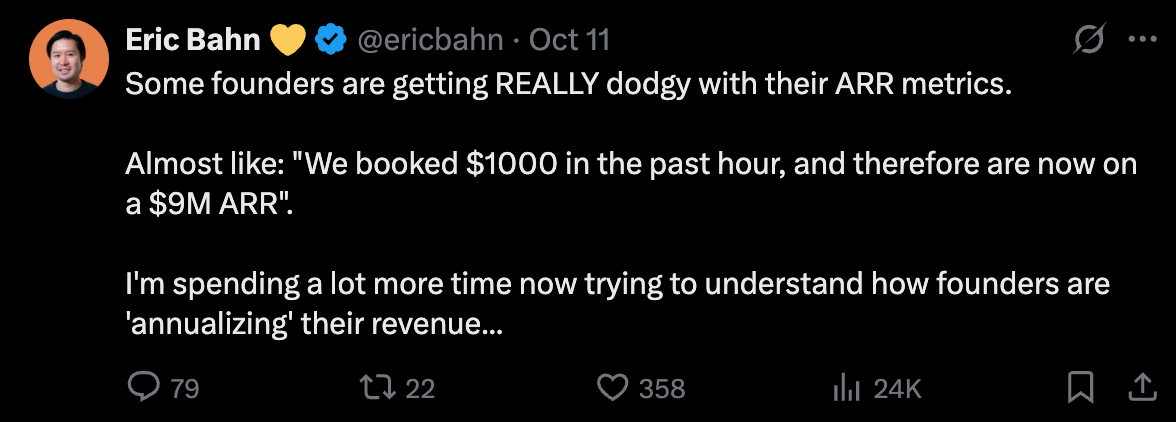

🎏 twitticisms

thanks for reading. feedback, tips or just want to say hi? reach out!

Good to have you back. “distribution is the surest moat!” 👌🏼