Island Fintech Weekly (9 May)

Greetings Islanders,

Welcome to Island Fintech Weekly’s very first edition! Vinay here. After spending some time in the Big Apple, I'm back in Singapore to start a new chapter.

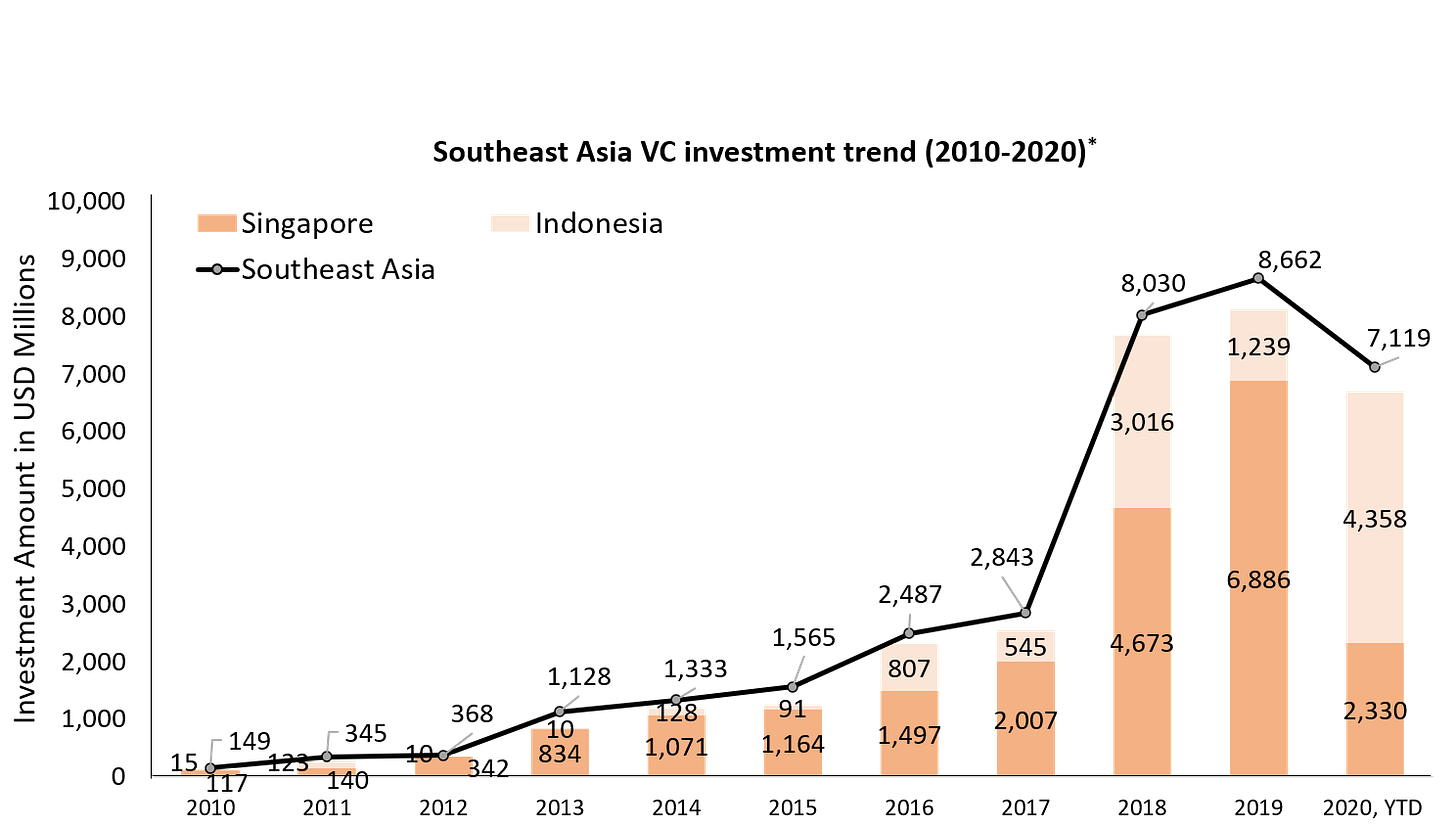

Apart my desire for some excellent hokkien mee, the big draw for me is the opportunity we have here in Southeast Asia (SEA). With a total population of more than 655 million, SEA accounts for about 8.5% of the world's population. There are more than 220 million underbanked individuals in SEA. In Indonesia alone, the underbanked account for 32% of the population. Solving the ‘underbanked challenge’ with smart technology, financial and regulatory changes is a rare chance to create legitimate financial inclusion. Coupled with this, fintech funding in SEA has grown 19X in just five years. If everything goes per plan, the region’s digital payments industry should grow to USD $1.2 trillion by 2025.

I’m challenging myself to keep track of it all. So I’ve decided to try and summarise every week’s SEA fintech news into a newsletter format.

Estimated read time: as long as it would take you to down a warm cup of kopi.

Every now and then, we’ll also be looking about the things that are happening across the pond - the US and UK in particular (the OGs of fintech, after all). Also, there are so many great fintech and banking writers out there - I hope to feature some of their writings here too. And while I’m at it, thanks so much for joining me!

Note: If you’re interested in contributing content or getting involved with Island Fintech Weekly, reach out to me! vinay.palathinkal@gmail.com.

🐠 Dips

Brex hit a $7.4B valuation after their series D round, and are aiming at going beyond credit card issuance and attacking a whole suite of enterprise needs, such as expense management and reporting.

Marqeta, the card issuing and payment processing provider to much of the US fintech community, is prepping for an IPO that could value it at $15 billion.

Barclays partners with Amount in the US, using their bank-friendly API to get a foot in the door with buy-now-pay-later payments.

Stripe acquired US-based TaxJar, moving beyond international expansion-related acquisition and doubling down on existing offerinhd in the US.

StashAway, a Singapore robo-advisor, raised a $20 million Series A round led by Sequoia, weeks after rival investment platform Endowus raised a S$23 million Series A led by Lightspeed and Softbank.

🐋 Dives

🇸🇬 Carta lands on Singapore’s shores, looking to grow in Asia.

Carta, a name familiar to those who have worked in global VC-backed startups, has now opened an office in Singapore, forming its base for Asia. If you haven’t heard of Carta, they help with capitalisation table management for employees to manage their holdings and recently hit a USD $6.9 billion valuation. Carta enjoys wide industry adoption, with 17,000 companies on their platform, and recently launched a private markets product called CartaX - it currently lists only its own shares, however.

Carta says that this move to Singapore is because there is so much equity to be managed in the region, and Singapore is taking the lion’s share.

Given Carta’s US focus, solving for a fairly context-specific problem - equity issuance for SEA, will be challenging. Carta lacks the status of being a transfer agent in SEA.

See below from their support page:

Issuing securities: Carta is not a registered transfer agent outside of the United States. This means that while we can track your equity, you cannot issue securities on our platform. You will need to maintain your true stock record with a transfer agent or share register in your jurisdiction, which may include issuing and retaining paper certificates.

Without a transfer agent license, Carta will act solely as a tracking tool. At least, initially, while it acquires the relevant licenses. Acquiring a transfer agent license is an easier task when you have physical presence in a country - so this also helps explain setting up an office in Singapore. Given that Singapore attracts the majority of funding, it seems like the most sensible place to start acquiring that license and being able to have a first-mover advantage in equity issuance in SEA.

💸 Two national P2P systems link up.

PayNow and PromptPay are real time P2P payment networks in Singapore and Thailand respectively. In a new partnership between the financial regulators between the two countries, folks can send money with limited hassle - just a mobile number; no additional KYC, with the ability to send SGD $1,000 or THB 25,000 daily at near-instant speeds. As both systems are part of government-syndicated payment initiatives, the capabilities for payouts and pay-ins are possible for all affiliated banks, so most major bank consumers can use this service. Three of Singapore’s 12 PayNow banks are participating in the scheme - DBS Bank, OCBC Bank and UOB - together with four banks in Thailand - Bangkok Bank, Kasikorn Bank, Krung Thai Bank and Siam Commercial Bank.

Now, while convenient, the main issue I see with this service is this right here - major banks handle this - and charge between 3-5% per transfer. Given the long history of mainstream banks being expensive for international remittance, the fact that such fees still exist is not particularly unexpected - and they are likely to remain so. As the PromptPay and PayNow collaboration does not introduce a fundamental decoupling from regular cross border payment operations here, the fees, sadly, also remain fairly high. Of course, more savvy customers can still opt for alternative cross border payments providers and experience better rates whilst enjoying relatively similar levels of convenience.

💰 A second attempt at an institutional blockchain protocol for SEA.

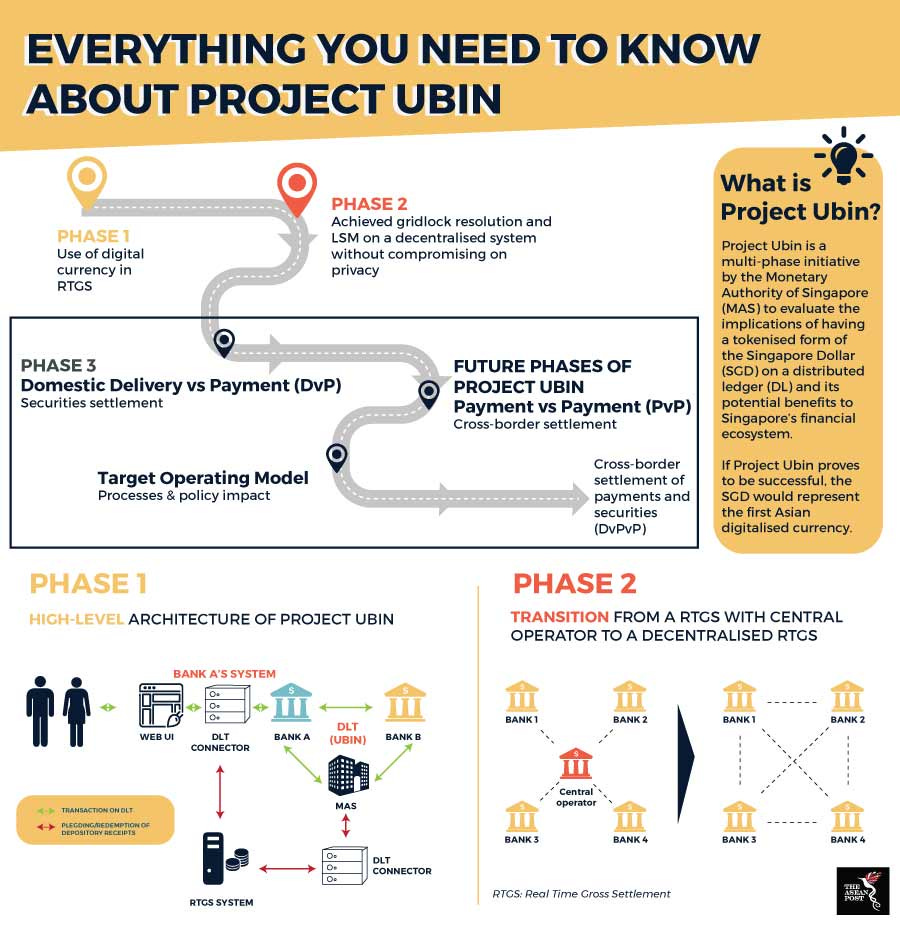

First, it was Project Ubin - way back in 2016. Temasek, Singapore’s sovereign wealth firm, and MAS, the state regulator, came together to try and build their own blockchain protocol to be used by banks. The focus was on ‘faster, less costly cross-border transactions, foreign currency exchange and smart contracts for escrow and trade’. During the crypto winter of 2018-19, industry support seemed to wane - and the supposed bank pilots never really took off.

Fast forward to 2021. It’s been five years and we don’t seem to see much talk about Project Ubin. SGD has also yet to become a digital currency. But there’s been newly garnered institutional support around cryptocurrency. Visa said that they are moving into crypto in a ‘very, very big way’, Goldman is introducing cryptocurrency investments as part of their wealth management portfolio. And so it seems fitting that the Ubin initiative could use a reboot. MAS and Temasek have brought on JP Morgan, bringing things back by way of a company called Partior. Aimed at being a country-agnostic open payments protocol, Partior seems to be a little bit more specific than Ubin. The below is from their press release.

When complete, the platform aims to provide 24/7 infrastructure that will enable financial institutions and developers to co-create applications that support use cases such as FX Payment Versus Payment (PVP), Delivery Versus Payment (DVP) and Peer-to-Peer escrows to complement and value-add to global financial ecosystems… the platform will start with a focus on facilitating flows primarily between Singapore-based banks in both USD and SGD.

Essentially, this is a re-imagining of the Project Ubin protocol, but with a specific focus around interoperability in Singapore-US banking systems. While I like the fact that this is a narrower and more targeted play, I’m still hesitant to believe that this may translate into adoption anytime soon. There are two parties that need to be convinced - banks and consumers (companies and individuals). Major banks already service the products (DVP, PVP, P2P) that are currently listed, and they do so without blockchain-based foundations.Building support for the new rails will require a fair amount of technical support, and not to mention approvals internally and externally, with MAS to begin with. Since the project is co-led by MAS, the latter will likely be easier to navigate. However, getting banks on board will remain a herculean task, and I’m not certain that this will be an easy path to tread anytime soon.

Let’s go to the second party - consumers. According to the release, Partior claims to help consumers achieve lower costs and faster payments. But the words independent, open source, or decentralised, some common blockchain-speak, were not stated in the release - because these terms don’t apply. By getting coupled within financial ecosystems, a decentralised (DeFi) peer to peer payments idea is turning into something that, instead, is rather centralised - something people are now calling CeFi. Settlement will occur within the banking rails, and banks are likely to charge some fees for the service, with the regulator providing oversight. The push around such initiatives really shows that incumbents are trying to use collaboration as a hedge against a potentially decentralised future. And that’s probably for the best. Barring the likelihood of nuclear armageddon, we’ll need institutional collaboration to provide a backbone of support for the development of new technologies in financial services. I could not express it better than Richard Gendal Brown:

Ultimately, real change in financial markets is driven by collaboration. Improvements to the way money and assets flow through the global financial system have almost always been achieved by successfully integrating a new technology with the existing infrastructure and institutions within it.

🏝 Twitticisms